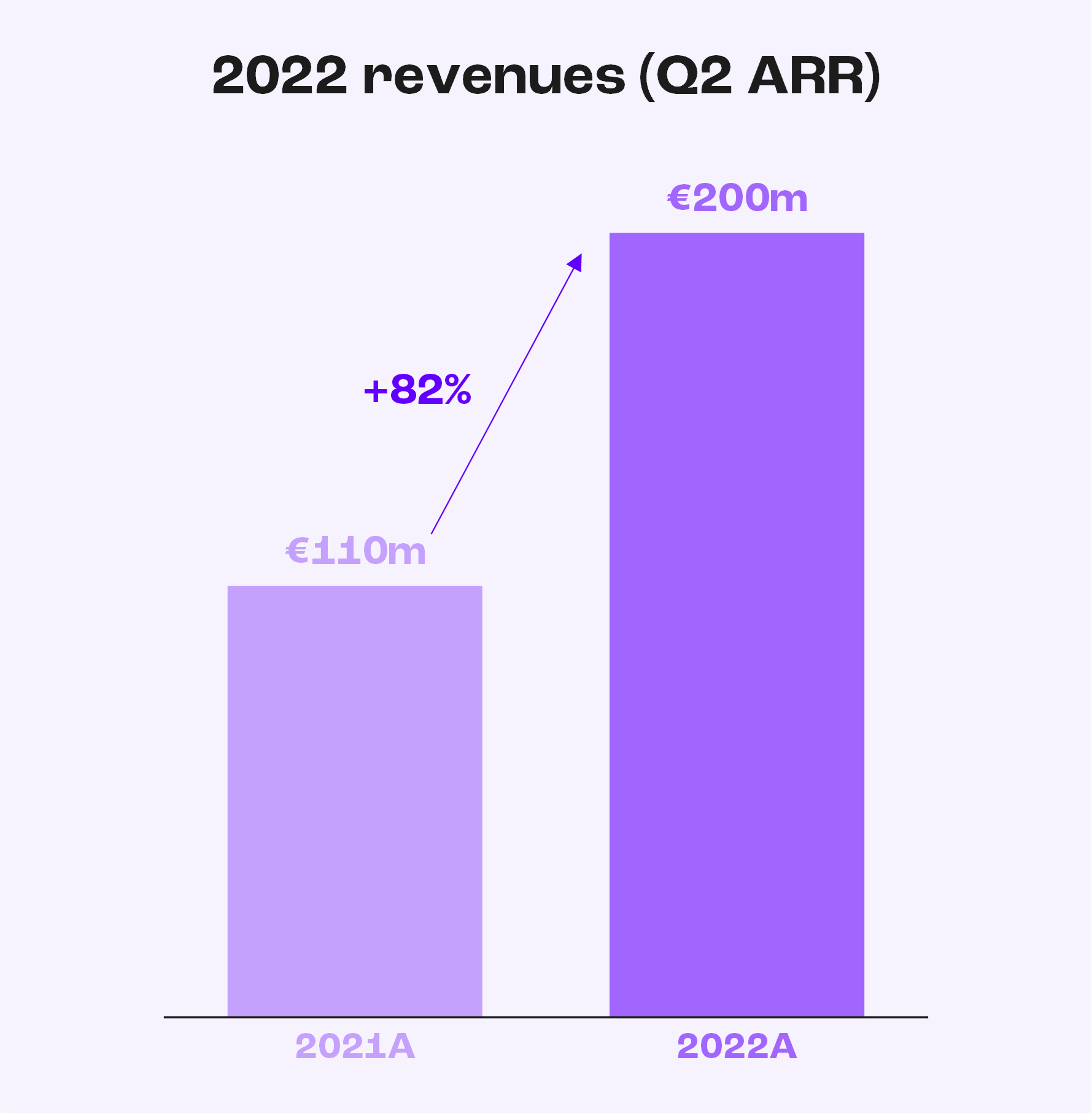

Younited reached the new milestone of €200m of annual revenue run-rate² in H1 2022, a +82% growth compared to prior year.

This confirms the Company’s continued growth profile after a +119% GMV growth and +81% net revenue³ growth in 2021 full-year.

CEO and co-founder of Younited

„The exceptional pace of our development testifies to the perfect match between our instant credit offer and the exponential needs of the e-economy in Europe. Today's consumers want more immediacy, more simplicity, whether they are making a purchase at a merchant or obtaining credit directly on our platform. This is a major behavioral change. Today, we are proud to be the leader in serving this rapidly growing demand and growing our customer community every day, with an unparalleled level of satisfaction and loyalty."

Younited, who has always been on a mission to simplify the credit industry and make it more transparent for its customers, is rolling-out its instant credit product.

Based on open banking⁴ – the possibility for customers to opt for sharing their bank details - this product offers the simplest journey and a decision in seconds.

The Company launched it for PoS loans Via Merchant Partners in 2018, rolled it out to its Direct-to-Consumers (DTC) channel in France in Q4 2021 and is now rolling it out to Spain in Q4 2022 and Italy, Portugal, and Germany in 2023.

It today accounts for c. 40% of credits financed through France DTC channel, with a target of 80% by end 2023.

Launched in Q4 2018, this solution offers the possibility for Partners to use Younited credit technologies and expertise for the benefit of their clients.

Merchants can deploy, in a matter of days, a new financing solution for baskets up to €50,000 and terms up to 84 months, with a seamless journey for the purchaser and all the customer protection guarantees offered by a regulated amortizing credit.

Financial institutions can offer, also in a matter of days, a new credit product on their platforms, leveraging 10+ years of Younited expertise.

Both solutions are available in point-of-sale and online with the same frictionless journey.

Via Partners GMV quadrupled in 2021 and is expected to almost double in 2022.

COO and co-founder of Younited

„2022 marks a major inflection in our Via Partners channel growth. We have demonstrated that our deployment model by country and by industry vertical offers exceptional acceleration opportunities in Europe. We have become the leading instant credit partner in electronics, telecom, and neo-banking industries by deploying our plug and play technology in a fully integrated way on the platforms of our partners, such as Apple Premium Resellers, Microsoft, Bouygues Telecom and Orange. We intend to replicate these successes in other high-potential verticals to continue to accelerate our pace of growth."

Younited’s is on a journey to simplify the credit industry and make it more transparent and responsible for the benefit of its customers.

Towards this goal, it has made the choice to offer the simplest, fairest, and most protective credit product of the industry: regulated fixed-rate amortizing credit.

This choice goes for unsecured credit as well as point-of-sale credit used to finance a purchase via merchant partners. Younited hence distinguishes itself from BNPL players offering unregulated split payment solutions with poor solvency analysis and low customer protection guarantees.

In addition to this, Younited provides differentiated interest rates to customers based on a thorough solvency analysis, while most competitors offer the same rate. This reflects the Company’s will to put the customer first and offer the most adequate product based on individual criteria, which translates into high customer satisfaction (4.8/5 Trustpilot score).

Importantly, Younited launched late 2021 a new budget advisor solution with the objective to help its customers save money and reach financial well-being. Based on open banking, this free solution analyses customers’ bank details and makes personalized saving recommendations (e.g., change of service provider).

¹ GMV = Gross Merchandise Value = Credits originated through Younited platform

² Q2 run rate of total revenues generated through the Younited platform

³ Net of provisions for cost of risk and cost of funding (both b/s and off b/s)

⁴ Open banking, access to individuals’ banking account details for those opting for it, has been enforced by the second European Payment Service Directive (PSD2)